Understanding the Australian Bond Market

The Australian bond market is a vibrant and essential component of the country’s financial landscape, offering a variety of investment opportunities. Here, investors can choose from government, corporate, and municipal bonds, each with its unique risk and return profile. The government bonds are considered the safest, backed by the Australian Government’s promise, while corporate and municipal bonds offer higher yields, reflecting their increased risk levels.

The Role of the ASX in Bond Trading

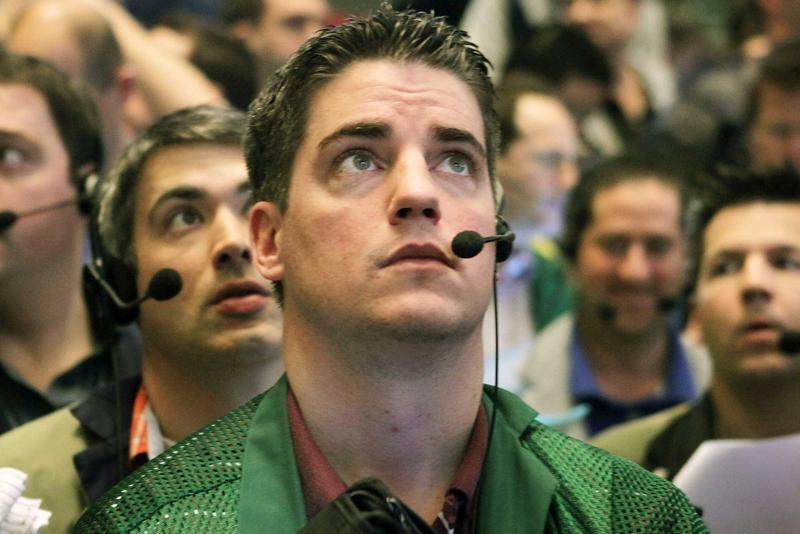

The Australian Securities Exchange (ASX) plays a pivotal role in the trading of bonds, providing a transparent and efficient platform for investors. It’s here that the pulse of the market can be felt, with real-time data and analytics guiding investment decisions. The ASX not only facilitates the buying and selling of bonds but also offers educational resources, making the bond market accessible to both novice and experienced investors alike.

Understanding the nuances of the Australian bond market is crucial for navigating its waters successfully. With a mix of government, corporate, and municipal bonds, investors are spoilt for choice, yet each requires a strategic approach. The ASX stands as a beacon, guiding through the complexities of bond trading with its robust platform and wealth of resources.

Strategies for Navigating the Bond Market

Assessing Risk and Return

Evaluating the landscape of investment opportunities requires a keen understanding of both risk and return, particularly in the bond market. Credit risk becomes a pivotal factor, where credit ratings serve as a compass, guiding investors through the terrain of investment choices. These ratings, symbols of financial health, are crucial for making informed decisions. A high rating suggests a low risk of default, offering a beacon of security in the tumultuous sea of investments. Conversely, lower ratings, while indicating higher risk, may also signal higher potential returns, tempting the bold. Interest rate risk further complicates the journey, with its profound impact on bond prices. As interest rates rise, bond prices typically fall, and vice versa, creating a seesaw effect that requires careful navigation. This dynamic dance between bond yields and market prices underscores the intricate relationship that exists within the bond market. Yields move inversely to prices, a fundamental principle that investors must master. By understanding this relationship, investors can better anticipate market movements and position their portfolios for success.

- Credit ratings are key to understanding investment security.

- Interest rate risk influences bond prices, demanding vigilance.

- The bond yield-market price relationship is central to investment strategy.

Strategies for Navigating the Bond Market

Investment Strategies for Australian Bonds

Diversification is the cornerstone of mitigating risk in bond investments. By spreading investments across various types of bonds, investors can shield their portfolios from the volatility of any single asset class. This approach balances the scales between risk and return, ensuring a smoother investment journey. The choice between long-term and short-term bond investments hinges on individual financial goals and market outlook. Long-term bonds typically offer higher yields, reflecting the extended commitment and increased risk. Conversely, short-term bonds provide a safer haven, with lower yields but reduced exposure to interest rate fluctuations. The ladder strategy emerges as a harmonious blend of security and income. By constructing a bond ladder, investors stagger the maturity of their bonds, creating a steady stream of income. This strategy not only secures a consistent return but also offers flexibility, allowing investors to adapt to changing market conditions.

- Diversification balances risk and return.

- Long-term vs short-term bonds cater to different investment horizons.

- The ladder strategy ensures steady income and flexibility.

Strategies for Navigating the Bond Market

The Impact of Economic Indicators on the Bond Market

Inflation is a double-edged sword in the bond market. As it rises, bond prices tend to fall, pushing yields up in response. This inverse relationship is pivotal, as higher inflation erodes the purchasing power of a bond’s future cash flows, making them less attractive to investors. The Reserve Bank of Australia’s monetary policy plays a crucial role, too. By adjusting interest rates to manage economic growth and inflation, it directly influences bond yields. Lower interest rates can boost bond prices, while higher rates exert downward pressure. Moreover, global economic factors cast a wide net, affecting the Australian bond market. International trade dynamics, geopolitical events, and global financial market trends can sway investor sentiment, impacting bond prices and yields. Understanding these influences is key to navigating the complexities of the bond market, allowing investors to make informed decisions and strategize effectively.

- Inflation inversely affects bond prices and yields.

- Monetary policy by the Reserve Bank of Australia directly impacts bond markets.

- Global economic factors play a significant role in shaping the Australian bond market.

Navigating Tax Considerations in Bond Investing

Understanding the Tax Implications of Bond Investing

Investing in bonds requires a strategic approach, not just in selecting the right bonds but also in managing the tax implications. The tax treatment of bond investments can significantly affect returns. For instance, interest income from bonds is typically taxed at the investor’s marginal tax rate, making it crucial to consider tax-efficient investing strategies. Moreover, the role of franking credits in corporate bond investments cannot be overlooked. These credits can offset the tax payable on dividends, providing a tax advantage to investors in corporate bonds. By understanding these elements, investors can navigate the tax landscape effectively, enhancing their overall returns.

- Tax-efficient bond investing strategies are essential for maximizing returns.

- Franking credits offer a tax advantage in corporate bond investments.

- Understanding the tax implications is crucial for informed investment decisions.

Navigating Tax Considerations in Bond Investing

Understanding the tax implications of bond investing is paramount for maximising returns. Tax-efficient strategies can significantly enhance the attractiveness of bond investments. For instance, investing in bonds that offer franking credits can provide a tax advantage. Franking credits, attached to the dividends from corporate bonds, can offset the tax payable on income, making them a savvy choice for tax-conscious investors. Additionally, recognising the different tax treatments between government and corporate bonds is crucial. Government bonds, generally considered lower risk, offer interest income that’s taxable at the investor’s marginal rate. In contrast, corporate bonds might come with franking credits, reducing the overall tax burden.

- Tax implications vary between government and corporate bonds.

- Franking credits can offset income tax, enhancing returns.

- Choosing tax-efficient bond investments is key to maximising portfolio performance.

Navigating Tax Considerations in Bond Investing

Understanding the tax implications of bond investing is paramount for maximising returns. Tax-efficient strategies can significantly enhance the attractiveness of bond investments. For instance, investing in bonds that offer franking credits can provide a tax advantage. Franking credits, attached to the dividends from corporate bonds, can offset the tax payable on income, making them a savvy choice for tax-conscious investors. Additionally, recognising the different tax treatments between government and corporate bonds is crucial. Government bonds, generally considered lower risk, offer interest income that’s taxable at the investor’s marginal rate. In contrast, corporate bonds might come with franking credits, reducing the overall tax burden.

- Tax implications vary between government and corporate bonds.

- Franking credits can offset income tax, enhancing returns.

- Choosing tax-efficient bond investments is key to maximising portfolio performance.

Ethical and Sustainable Bond Investing

Introduction to Green Bonds and Social Bonds

Amidst the growing concern for environmental sustainability and social welfare, green bonds and social bonds have emerged as powerful tools for investors. Green bonds finance projects with positive environmental impacts, such as renewable energy or pollution control, while social bonds focus on projects with significant social benefits, including affordable housing or education. These instruments not only offer a competitive return but also allow investors to contribute to a more sustainable and equitable world.

How to Evaluate the Impact of Your Bond Investments

Evaluating the impact of bond investments requires a thorough analysis of the projects they finance. Investors should look for transparency in how funds are used and seek out bonds with clear, measurable outcomes. Third-party certifications, such as the Climate Bonds Standard, can provide assurance that investments truly contribute to environmental and social objectives. By prioritizing bonds that demonstrate tangible impacts, investors can ensure their capital serves a dual purpose: generating returns and driving positive change.

The Growing Market for Ethical Bond Investments in Australia

The Australian market for ethical bond investments is expanding rapidly, reflecting a broader global trend towards sustainability. Investors are increasingly drawn to opportunities that align with their values, driving demand for green and social bonds. This surge in interest has prompted more issuers to enter the market, diversifying the available options and enhancing liquidity. As the market matures, the potential for ethical bond investments in Australia looks promising, offering a win-win scenario for investors and society alike.

- Green and social bonds align investments with environmental and social goals.

- Evaluating impact is crucial for meaningful ethical investments.

- The market for ethical bond investments in Australia is flourishing, driven by investor demand for sustainability.

In Closing

Navigating the Australian bond market offers a path to financial resilience. This journey, while complex, is made navigable through strategic investment and risk management. By balancing the allure of high returns against the backdrop of economic indicators and tax considerations, investors can craft a portfolio that stands the test of time. Incorporating ethical considerations further enriches this venture, aligning financial growth with societal values. As the landscape evolves, embracing these strategies promises not only wealth accumulation but also a contribution to a sustainable future.

Navigating the Australian bond market offers a path to financial resilience. This journey, while complex, is made navigable through strategic investment and risk management. By balancing the allure of high returns against the backdrop of economic indicators and tax considerations, investors can craft a portfolio that stands the test of time. Incorporating ethical considerations further enriches this venture, aligning financial growth with societal values. As the landscape evolves, embracing these strategies promises not only wealth accumulation but also a contribution to a sustainable future.